Mega Millions Jackpot Analysis

We are going to analyze the MegaMillions Lottery Jackpot. Mega Millions is the second-largest lottery in the USA in terms of the Jackpot amount. For analysis of the Mega Millions lottery jackpot, we have gathered data of the past 100 draws, and this Mega Millions Jackpot analysis will derive the conclusion. We will see how many different taxes will impose on our Jackpot amount and how much money we will finally get in cash or annuity breakups.

For cash payout, we will get the full amount after deducting taxes at the time of claim. But we have another option to get the Jackpot amount, that is Annuity. So if we choose the annuity option, then we will get money in 30 installments. The first installment you will get at the time of claim, and the other 29 installments you will get over the next 29 years.

Mega Millions lottery jackpot winning amount is big, so the amount of taxes will also be huge. To calculate the taxes, We have developed a calculator to analyze the taxes on the Mega Millions lottery jackpot amount. You only need to select the state in which you have purchased the Mega Millions lottery ticket, and the analyzer will do its job to calculate the taxes, cash amount, and annuity amounts.

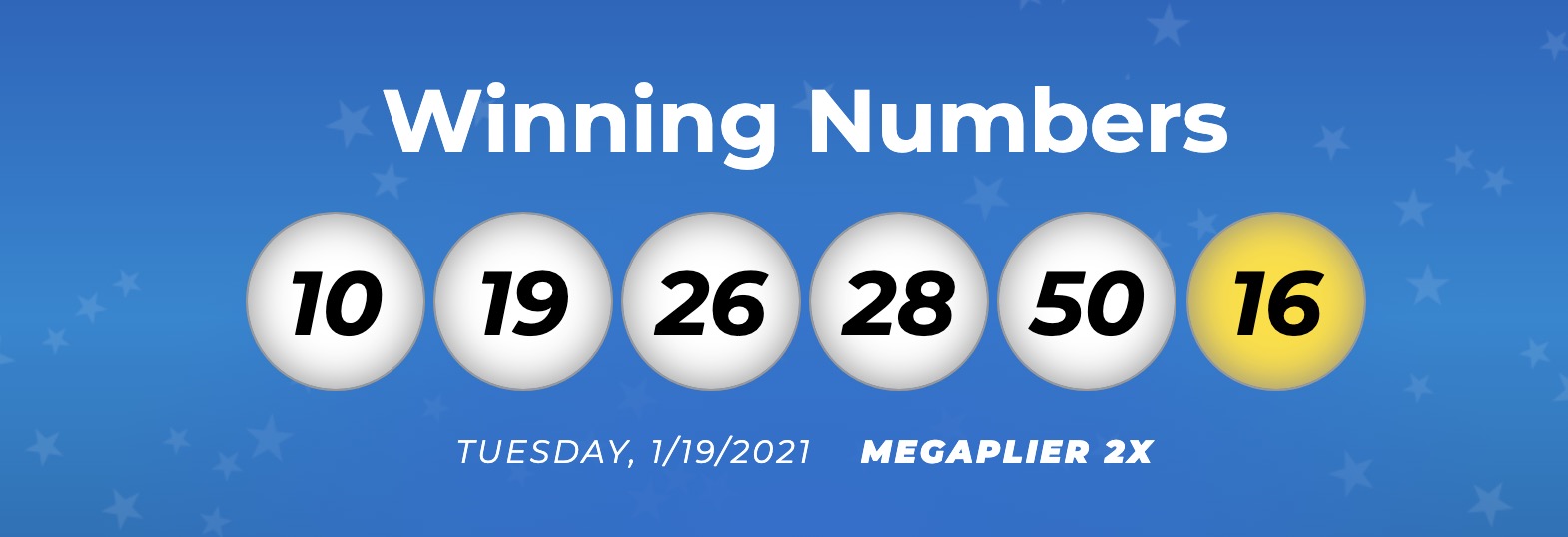

Powerball Jackpot Analysis and Tax. Below is an analysis of the current Powerball jackpot, showing both the advertised Annuity and Lump Sum amounts and their ultimate worth after taking into account federal and state tax. Mega Millions, players must choose five numbers from 1 to 70 and one Mega Ball from 1 to 25. Mega Millions was previously a 5/75 game, so various changes have taken place since then. Perhaps, the most exciting change is the increase in jackpot prize from $15 million to $40 million.

Mega Millions Lottery Jackpot Analyzer

Payout you receive first year will increase by 5% each year. State taxes on lottery winning will be paid separately as per your US state laws. Federal tax in USA is same for all the states, So you have to pay a standard amount of tax.

Nc Mega Millions Jackpot Analysis

$56 Million Jackpot Annuity Breakdown

Arkansas Mega Millions Jackpot Analysis

| Year | Gross Amount | Federal Tax | State Tax (0%) | Final Amount |

| 1 | -$311,866 | $531,015 | ||

| 2 | -$327,459 | $557,565 | ||

| 3 | -$343,832 | $585,444 | ||

| 4 | -$361,024 | $614,716 | ||

| 5 | -$379,075 | $645,452 | ||

| 6 | -$398,028 | $677,724 | ||

| 7 | -$417,930 | $711,610 | ||

| 8 | -$438,826 | $747,191 | ||

| 9 | -$460,768 | $784,550 | ||

| 10 | -$483,806 | $823,778 | ||

| 11 | -$507,996 | $864,967 | ||

| 12 | -$533,396 | $908,215 | ||

| 13 | -$560,066 | $953,626 | ||

| 14 | -$588,069 | $1,001,307 | ||

| 15 | -$617,473 | $1,051,373 | ||

| 16 | -$648,346 | $1,103,941 | ||

| 17 | -$680,764 | $1,159,138 | ||

| 18 | -$714,802 | $1,217,095 | ||

| 19 | -$750,542 | $1,277,950 | ||

| 20 | -$788,069 | $1,341,848 | ||

| 21 | -$827,473 | $1,408,940 | ||

| 22 | -$868,846 | $1,479,387 | ||

| 23 | -$912,289 | $1,553,356 | ||

| 24 | -$957,903 | $1,631,024 | ||

| 25 | -$1,005,798 | $1,712,575 | ||

| 26 | -$1,056,088 | $1,798,204 | ||

| 27 | -$1,108,892 | $1,888,114 | ||

| 28 | -$1,164,337 | $1,982,520 | ||

| 29 | -$1,222,554 | $2,081,646 | ||

| 30 | -$1,283,682 | $2,185,728 |